Global Emerging Markets

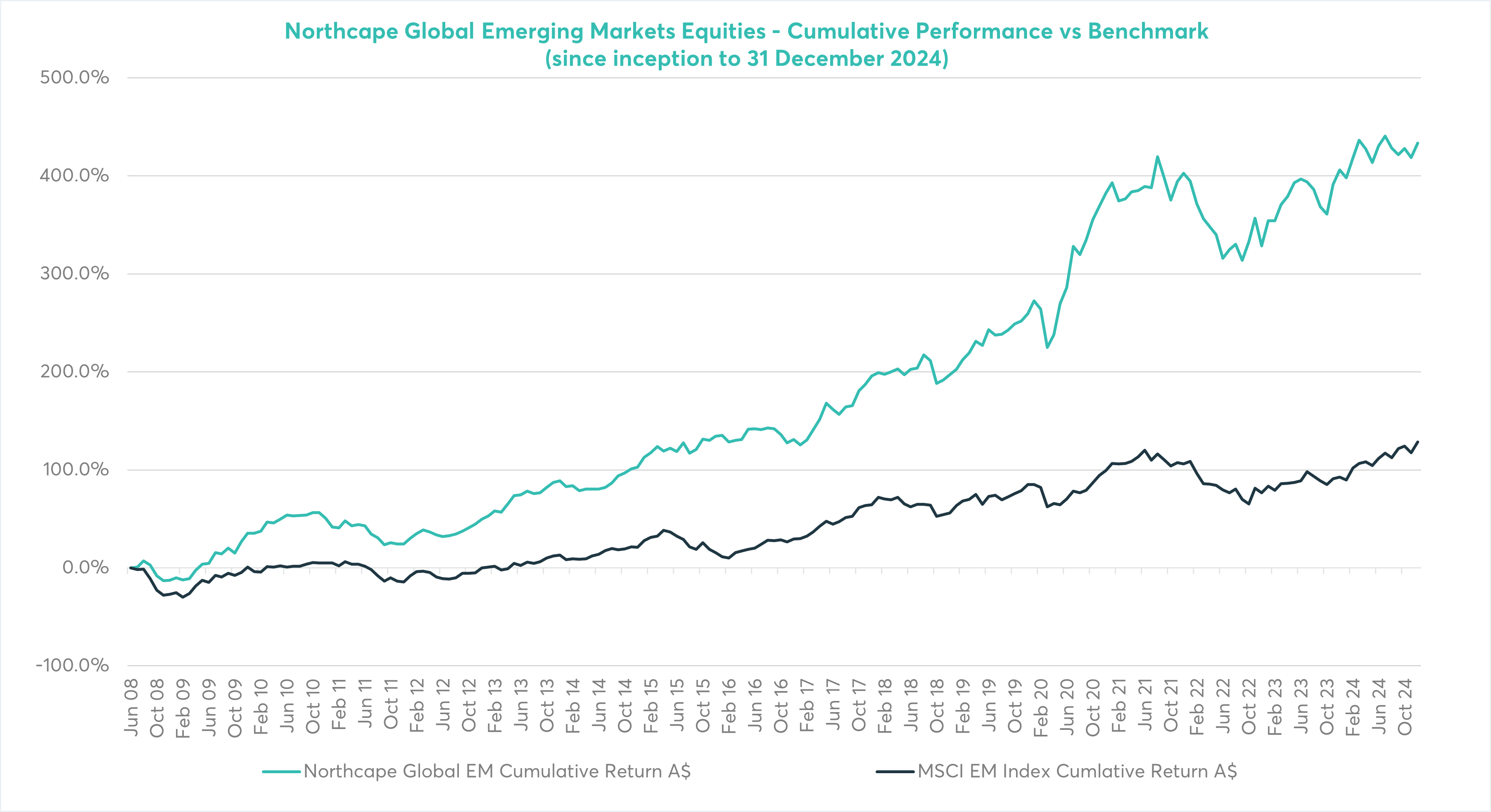

Our Global Emerging Markets equity strategy was established in 2008. It offers a concentrated portfolio of high quality businesses in emerging markets. Our fundamental investment research is focused on identifying companies with sound ESG practices, strong balance sheets, high returns on capital and that are addressing large, growing markets. Our bottom-up research is blended with our proprietary sovereign risk analysis. We are patient investors with a long-term investment horizon. The outcome is a low turnover portfolio of carefully selected businesses that delivers resilient and sustained performance for clients.

| Investment Objective | To outperform the benchmark over rolling 3 year periods |

|---|---|

| Benchmark | MSCI Emerging Markets Index in A$ |

| Stocks held in portfolio | Typically between 15-40 high quality stocks |

| Investment Options | Discrete Mandate for Institutional clients only or Wholesale Trust* |

| Fund Inception | Northcape began managing money in this strategy for institutional clients in June 2008 |

| Investment Team | Patrick Russel, Ross Cameron, Tom Pidgeon, Cameron Robson, Oliver Johansson, Aimee Jordan |

Performance