Global Equities

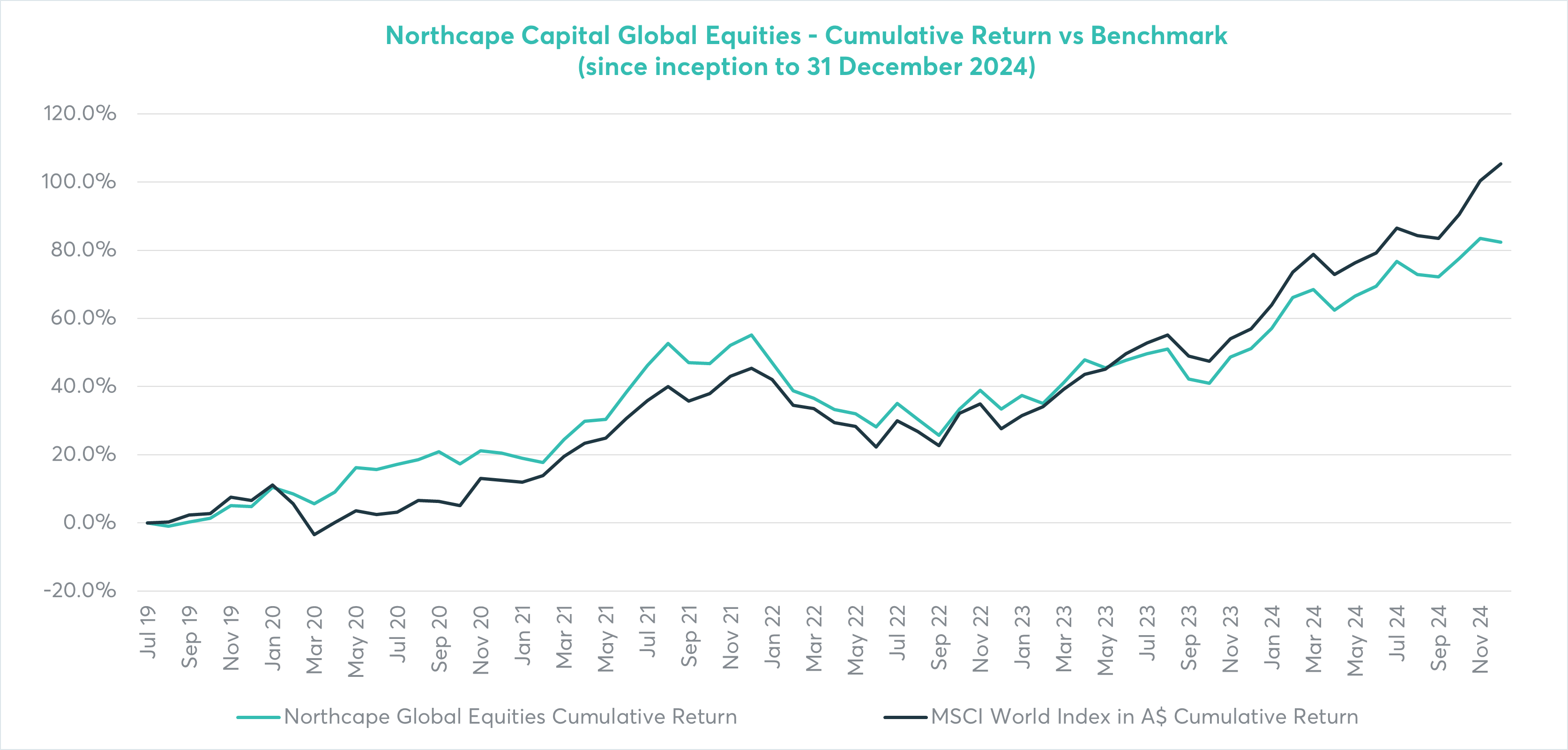

Our Global Equities strategy was established in 2019. It offers a concentrated portfolio of high quality businesses in global equity markets. Our fundamental investment research is focused on identifying companies that exhibit quality characteristics such as sustainable growth, strong profitability, a defendable market position, strong balance sheets and superior ESG. We are patient investors with a long-term investment horizon. The outcome is a low-turnover portfolio of carefully selected businesses that delivers resilient and sustained performance for clients.

| Investment Objective | To outperform the benchmark over rolling 3-5 year periods |

|---|---|

| Benchmark | MSCI World Accumulation Index in A$ |

| Stocks held in portfolio | Typically between 20-40 high quality stocks |

| Investment Options | Discrete Mandate for Institutional Clients only or Wholesale Trust* |

| Fund Inception | Northcape began managing money in this strategy in August 2019 |

| Investment Team | Fleur Wright, Theo Maas, Wendy Herringer, Jumana Nahhas |

Performance